Co-written by: Leanne Matthewson (Director)

In September 2020, the Office of State Revenue (OSR) introduced an important exemption for transfer duty and vehicle registration duty. The new exemption relates to small business restructures and removes a considerable barrier to restructuring sole traders, partnerships and discretionary trusts into private companies in certain situations.

The Barrier

Ordinarily, restructuring a small business so that it operates as a company involves paying transfer duty based on the market value of the business and its assets even though no money may be changing hands. Often, the cost of the transfer duty is too significant for the restructure to be viable.

| To transfer a small business with a dutiable value of | Duty payable |

| $5,000,000 | $268,025 |

| $4,000,000 | $210,525 |

| $3,000,000 | $153,025 |

| $2,000,000 | $95,525 |

| $1,000,000 | $38,025 |

| $500,000 | $15,925 |

The new exemption makes it considerably more affordable to restructure small businesses, provided they are eligible transactions.

The exemption applies to sole traders, partnerships and discretionary trusts:

- with a dutiable value of $10,000,000 or less;

- conducting business in Queensland;

- wholly or partly supplying land, money, credit, goods or services to customers in Queensland;

- having an annual turnover of $5,000,000 or less.

There are three types of restructures, which will benefit from the exemption.

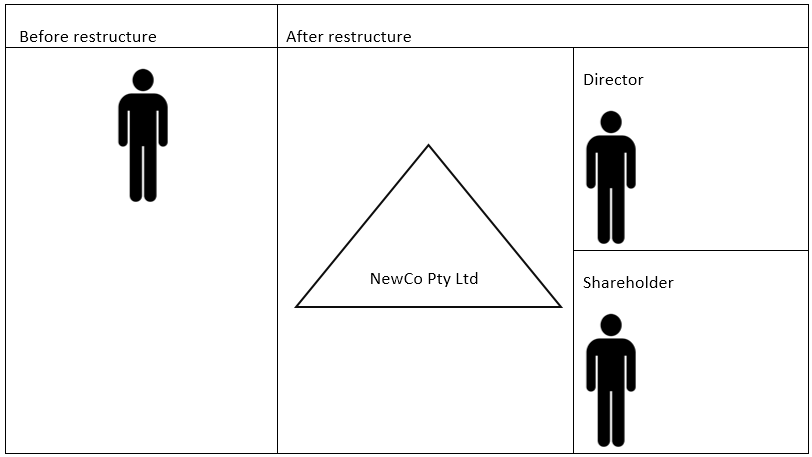

Sole trader to private company owned by the sole transfer

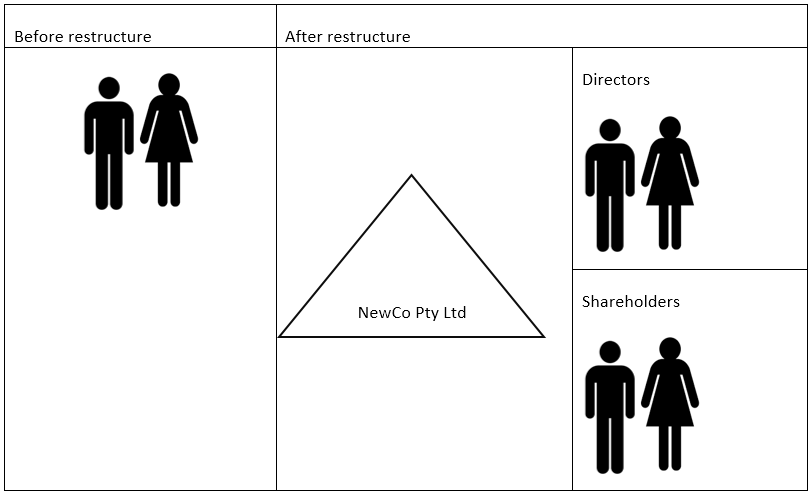

Partnership to private company owned by the partners

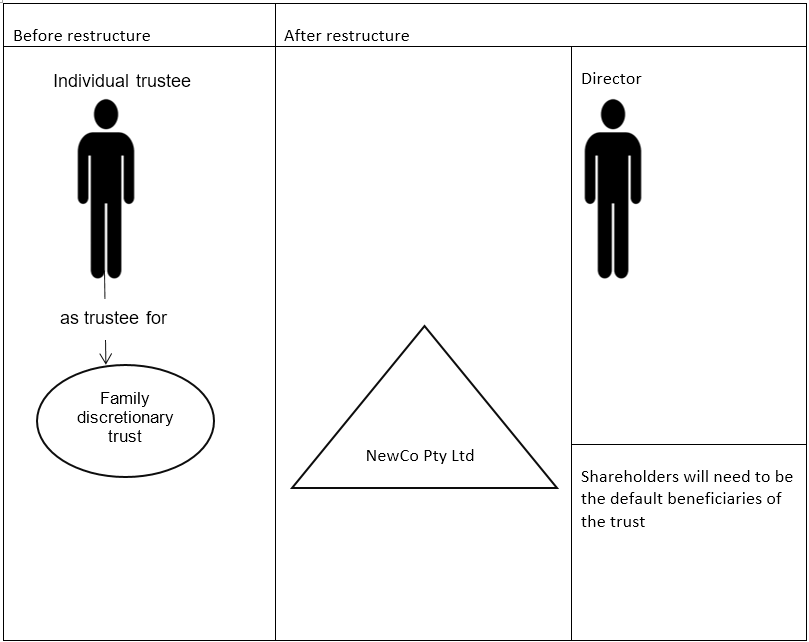

Discretionary trust to private company owned by the beneficiaries of the trust

If in a restructure there is a change in the ownership proportions, eg partner A owns 20% in a partnership before restructure, but then seeks to own only 15% of the shares post restructure because a new owner is being introduced, the exemption will only apply to the 15%.

Problem with sole traders

A sole trader is the simplest structure to use, however, it offers no asset protection. The assets of the sole trader are completely exposed to the risk of a claim relating to the business.

Using a company to operate a business provides some asset protection.

Problem with partnerships

In addition to the asset protection issues, one partner can be liable for the acts or omissions of another partner – they are jointly and severally liable.

Effective structuring

Effective structuring involves identifying the at risk individuals, utilising limited liability entities to minimise any detrimental impact on personal wealth and creating asset silos which segregate claim risk.

Getting a small business ready for sale

Restructuring into a private company can make a small business more attractive to a third party buyer.

In Queensland, provided the company is not land rich, transfer duty is not imposed on the transfer of shares. If, however, the company’s assets are to be sold to a third party, transfer duty will apply.

Transfer duty can be a considerable transaction cost. Removing it opens the door to significantly more transactions.

Financial, tax and accounting advice

Before doing any restructure, in addition to getting legal advice, a small business should get financial, tax and accounting advice that is specific to their circumstances. The impact of capital gains tax should be understood so it can be effectively managed.

For further information on this, please contact Our Brisbane & Toowoomba Business Lawyers:

Matt Bell

T 07 4616 9860

E [email protected]

Leanne Matthewson

T 07 4616 9812

E [email protected]

This publication has been carefully prepared, but it has been written in brief and general terms and should be viewed as broad guidance only. It does not purport to be comprehensive or to render advice. No one should rely on the information contained in this publication without first obtaining professional advice relevant to their own specific situation.