The Fair Work Commission (FWC) has published its decision to cut Sunday and public holiday rates under a number of modern awards.

Undoubtedly, you have seen the war of words erupt between the unions, various employer groups and politicians over this decision – but what does it actually mean for you?

Award covered employers and employees

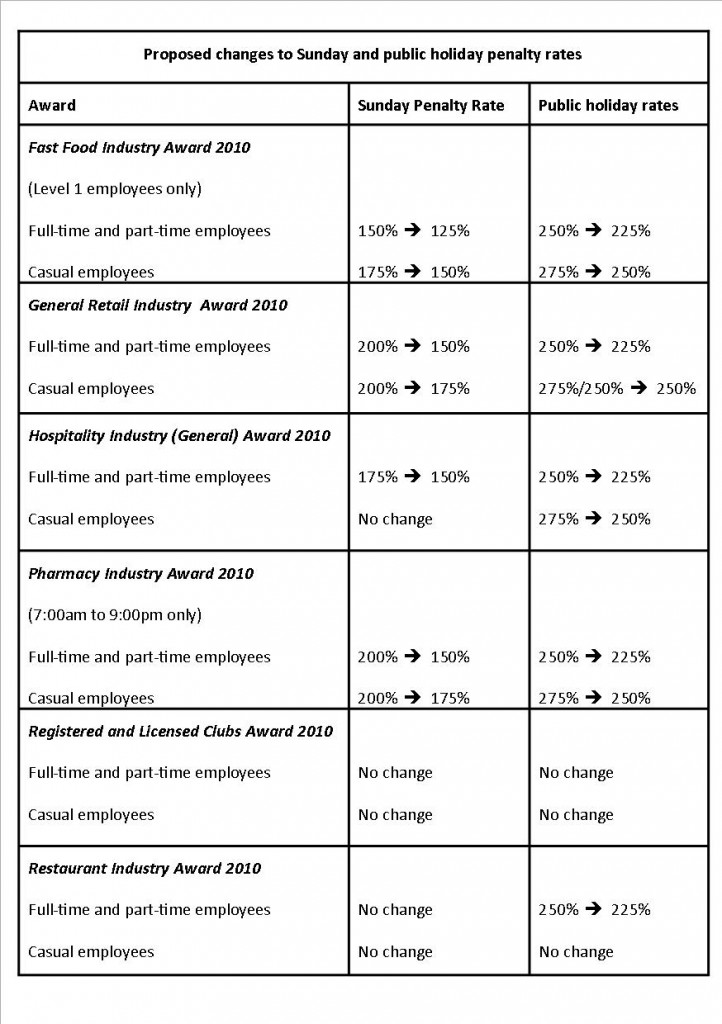

Summarised below are the cuts to Sunday and public holiday rates the FWC has decided to make under the listed modern awards. If one of these modern awards applies to your business or employment (and no enterprise agreement is in place), you will be affected by this decision.

Enterprise agreements

If your business (or your employer’s business) has an enterprise agreement in place, these changes will not affect you immediately, as the enterprise agreement will apply to the exclusion of the modern awards (and many enterprise agreements already contain reduced penalty rates in favour of higher base hourly rates). However, if your industry is covered by one of these modern awards, the changes will likely affect your employment or business when it comes time to implement or replace an enterprise agreement.

This is because enterprise agreements must be approved by the FWC, and pass what is known as the ‘better off overall test’ i.e. the enterprise agreement must result in the employee being better off overall than they would have been under the applicable modern award.

With cuts to Sunday and public holiday rates under these modern awards, it will be easier for future enterprise agreements to satisfy the better off overall test.

Implementation of this decision

The changes to public holiday rates under these modern awards will come into effect on 1 July 2017. However, the FWC has recognised the greater affect the cuts to Sunday penalty rates will have on employees, and has indicated it will put transitional provisions in place to ease the immediate affect of these cuts.

The FWC has proposed reducing the Sunday penalty rates incrementally over a number of years, and has called for submissions on these arrangements, with a further hearing to be held in early May 2017.

A decision on the late night penalty provisions under the Fast Food Industry Award 2010 and Restaurant Industry Award 2010 will also be published shortly.

Further changes on the horizon?

As you can see from the above table, there have been no changes to the rates under the Registered and Licensed Clubs Award 2010 (Clubs Award). The FWC has flagged two options for the future of it review of this award:

- 1. that the Clubs Award could be revoked, with a consequential change to the Hospitality Industry (General) Award 2010 so that it covers employees previously under the Clubs Award; or

- 2. giving interested parties a further opportunity to advance their case in support of any changes to weekend penalty rates under the Clubs Award.

Having reached the provisional view that option 1 has merit; the FWC has called for submissions on revoking the Clubs Award, with the matter to be listed for mention on 28 March 2017.

Additionally, there are still a number of issues for FWC to determine, and it has called for further submissions on whether:

- 1. Sunday penalty rates under the Restaurant Industry Award 2010 should be amended (having found that the submissions to date do not warrant any changes);

- 2. Sunday penalty rates under the Amusement, Events and Recreation Award 2010 and Hair and Beauty Industry Award 2010 should be changed;

- 3. the terminology of ‘penalty’ rates should be changed to ‘additional remuneration’ to reflect the fact that the goal of these rates is not to deter employers for rostering employees on weekends but to compensate staff for working weekends.

Want to know more? Contact Matt Bell, Director and Accredited Specialist Business Law on 07 4616 9860 or send Matt an email.

This publication has been carefully prepared, but it has been written in general terms and should be viewed as broad guidance only. It does not purport to be comprehensive or to render advice. No one should rely on the information contained in this publication without first obtaining professional advice relevant to their own specific situation.